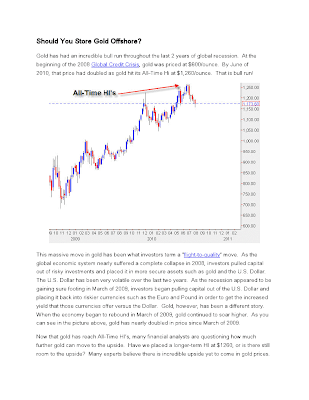

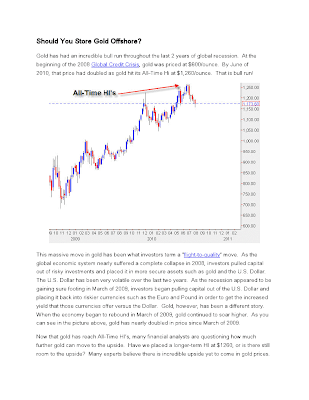

Gold has had an incredible bull run throughout the last 2 years of global recession. At the beginning of the 2008 Global Credit Crisis, gold was priced at $600/ounce. By June of 2010, that price had doubled as gold hit its All-Time Hi at $1,260/ounce. That is bull run!

This massive move in gold has been what investors term a “flight-to-quality” move. As the global economic system nearly suffered a complete collapse in 2008, investors pulled capital out of risky investments and placed it in more secure assets such as gold and the U.S. Dollar. The U.S. Dollar has been very volatile over the last two years. As the recession appeared to be gaining sure footing in March of 2009, investors began pulling capital out of the U.S. Dollar and placing it back into riskier currencies such as the Euro and Pound in order to get the increased yield that those currencies offer versus the Dollar. Gold, however, has been a different story. When the economy began to rebound in March of 2009, gold continued to soar higher. As you can see in the picture above, gold has nearly doubled in price since March of 2009.

Now that gold has reach All-Time HI’s, many financial analysts are questioning how much further gold can move to the upside. Have we placed a longer-term HI at $1260, or is there still room to the upside? Many experts believe there is incredible upside yet to come in gold prices. The fundamental reasoning is simple. A strong mistrust in fiat currencies is growing among the investment community.

A fiat currency is a currency that is not backed by any physical commodity. For example, in decades past, a person used to be able to exchange his $10 bill for $10 worth gold, but today that gold standard does not exist. Therefore, that $10 bill is only backed by the government that issues it, and this is the reason that investors are growing increasingly weary of fiat currency. During the economic crisis of the last two years, the U.S. government, and other governments around the world, has printed historically unprecedented amounts of money. Many experts argue that at some point in the future, this massive supply of U.S. Dollars in the world economy will cause rapid inflation which will devalue the U.S. Dollar significantly. The alternative is to hold gold. Gold is commonly thought of as an investment that will not lose value over the long term. When fiat currencies begin to fail and even be destroyed, gold will continue to hold value. Thus, many investors are continuing to turn to gold as a safe-haven investment. In the rest of this article we will address two things:

- Is it safe to store gold offshore?

- Is there a way to profit off an increase in gold and in a fiat currency?

Many experts suggest evenly distributing one’s gold assets among various locations. The reason is because if an economic meltdown does occur, and an investor has all of his gold in a particular safe-deposit box at a bank, he may not be able to get that gold out right away, or in the worst case scenario, ever. Thus, it is safe to diversify by placing gold in several locations, and one strategy includes storing some gold offshore. Where should one store gold offshore? Well, this ties in with the second question we will address. Is there a way to profit off an increase in gold prices and a fiat currency?

The short answer, possibly, is yes. Let’s assume that the U.S. Dollar is going to decrease in value over the long-term. Many economists are predicting this to happen. If the U.S. Dollar is going to decrease in value over the long term, it may be wise for an investor to purchase gold in a currency that is expected to increase over the long-term. One such example would be the New Zealand Dollar. The New Zealand Dollar tends to have one of the highest interest rates among developed nations.

One way that investors profit from this high interest rate in New Zealand is by taking U.S. Dollars, which carry an interest rate of basically 0% and putting that money into the New Zealand Dollar, which currently offers an interest rate of 3%. So, an investor is now earning 3% on his money with very little to no risk; however, he is subject to the volatile currency swings the forex news events can cause. As a rule of thumb, over the long term, a higher yielding currency should appreciate versus a lower yielding currency. Thus, by purchasing gold in New Zealand, an investor will expose his capital to a higher yielding currency, possibly profit from an increase in the exchange rate, and profit from the possible increase in gold prices. Not a bad deal!! Thus, buying and storing gold offshore in New Zealand, may be a wise alternative for investors.

(This article is a contribution from Martin Short of Forextraders.com)